What is inflation?

Inflation isn't the big bad villain mainstream media makes it out to be. Keep reading to learn about what inflation is and why it happens.

Inflation is the increase in the prices of goods and services over time, which means that the same amount of money buys less than it used to.

Remember when you could buy a pack of Skittles without having to take out a loan or sell your left kidney?

Nowadays, the cost of Skittles has increased by over 40 percent. You are better off putting that money towards your savings or emergency fund.

Odds are, you aren't relying on Skittles to get by (at least we hope you aren't). In Statistics Canada's Food Price Report 2025, the agency forecasts that food prices will increase by 3% to 5% in 2025.

The average family of four is expected to spend just shy of $17,000 on food, up over $800 from 2024.

Inflation is so problematic because it affects everything, not just your favourite childhood candy or groceries.

Upping your knowledge about inflation will help you not just stay afloat during times of economic stress, but get ahead.

Why does inflation happen?

Increased demand

If more people want to buy a product than what’s available, sellers can raise prices. For example, the price of candy skyrockets during Halloween when people buy the cavity-inducing sweets in bulk. High demand isn’t the only reason companies inflate their prices.

Let's say Mexico, the world's largest producer of avocados, experiences a drought that drastically reduces crop yields.

To compensate for reduced supply, producers might opt to raise the price of their avocados. The avocados you used to buy for $5.99 now cost $7.99.

Increased costs for businesses

Inflation affects businesses, too. If the cost of operating and making products rises, such as higher wages or more expensive materials, companies tend to pass these costs on to consumers. This allows companies to protect their margins while keeping up with inflation.

However, grocery stores like to inflate their prices beyond the inflation rate (looking at you Galen Weston).

For example, the cost of Nestle’s 50-piece box of chocolates outpaced inflation by over 17 percent in 2023 at major grocery chains in Canada like Loblaws and Metro.

More money in circulation

An increase in an economy's money supply can cause inflation because people have more to spend, but there aren’t necessarily more goods to buy. This can lead to higher prices, as there’s more money chasing the same amount of goods.

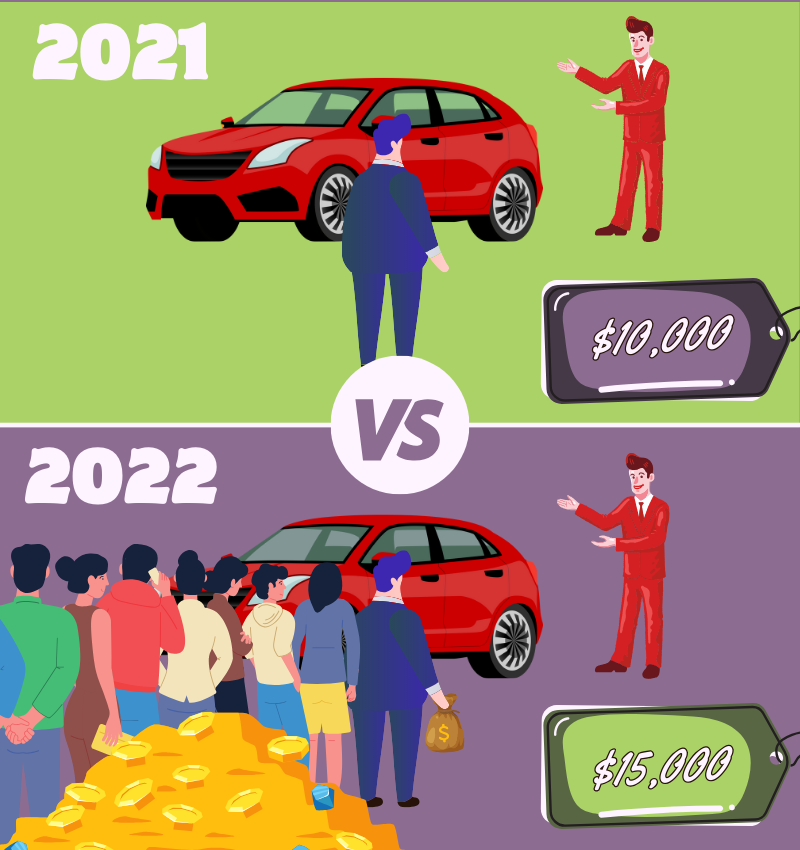

Let’s say you set aside $10,000 to put towards a car when you graduate college next year.

When you graduate, you notice the car you want costs $5,000 more than it did a year ago. Since there is more money in circulation, more people are interested in buying the same vehicle as you.

While the price of the car has increased, the number of cars for sale remains the same. For most companies, including car manufacturers, it is more realistic and feasible to increase prices than production.

You end up in a scenario where demand outpaces supply, leading to higher prices. A small amount of inflation is usually normal and even a sign of a healthy economy.

It encourages spending and investment because people know that prices will gradually rise, so they’d rather buy things sooner than later. However, high inflation can be problematic.

If prices rise too quickly, wages might not keep up, making it harder for people to afford common expenses like food or rent. Just look at Alberta.

The province's rate of inflation spiked to 4.2% in February 2024, the highest in the country and well above the national average at the time (2.8%).

The two biggest factors contributing to Alberta's increased rates were higher gas prices and shelter costs, which includes rent, mortgages, property tax, and home insurance.

Shelter costs increased due to the demand for housing far outpacing the supply. The result was many Albertans having to choose between putting food on the table or paying their bills.

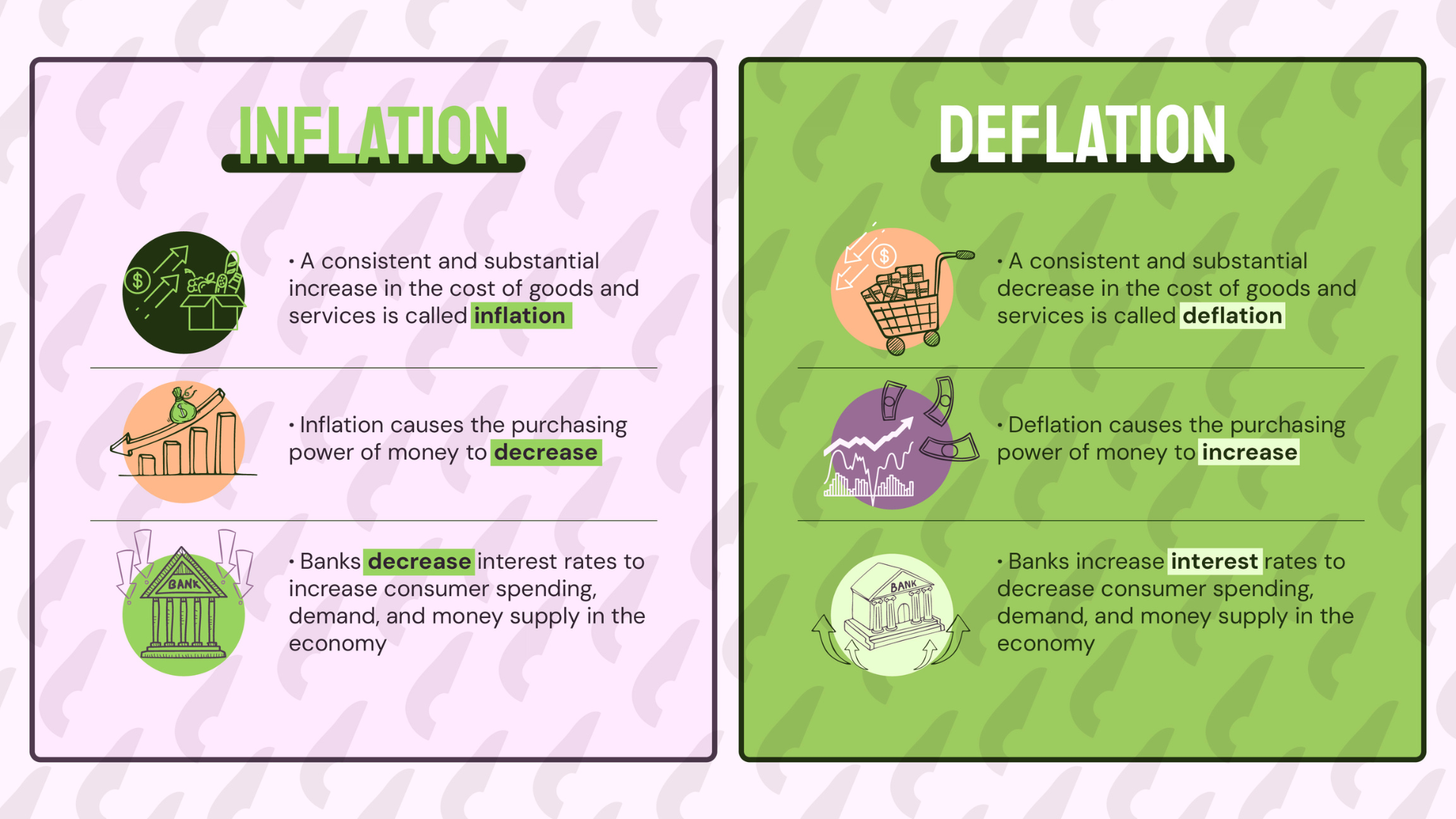

On the flip side, if inflation is too low, it might signal economic stagnation, where people aren’t spending enough, which can lead to businesses slowing down, cutting jobs, or reducing wages.

When inflation is low and the economy stagnates, this is referred to as deflation.

As you have probably noticed by now, consumers always draw the short end of the stick when inflation gets out of hand.

Unlike corporations or your creepy landlord, consumers can't just pass off higher prices associated with inflation to someone else.

TL;DR

Is Superbowl night feeling pricier? Is your favourite tub of guacamole no longer fitting into your budget? Do you have more money but feel like you are stuck buying less? These are telltale signs of inflation.

Now that you know what inflation is and why it happens, you can start recognizing the signs early. Don't wait for mainstream media to scream and shout about it.

As soon as you catch a whiff of inflation, take steps to protect yourself like investing in an emergency fund, starting or revisiting your budget, or investing in a savings account.

Don't let something like inflation stop you from making your money work for you.