What is deflation?

Deflation is like a bad dating experience. It might seem great at first, but the more time you spend with it, the more you realize deflation is bad news.

Deflation is inflation's less popular sibling that we don't often hear about. Like inflation, deflation is okay in small doses but can devastate an economy over a long period.

Deflation happens when prices fall across an economy, making goods and services cheaper. This might sound great, but deflation often comes with lower wages, higher unemployment, decreased spending, and more.

Luckily we are here to give you some key information about why deflation happens, how it affects you, and what you can do to protect yourself, so that you can stay on top of your finances even during times of economic downturn. Here's what you need to know to stay two steps ahead.

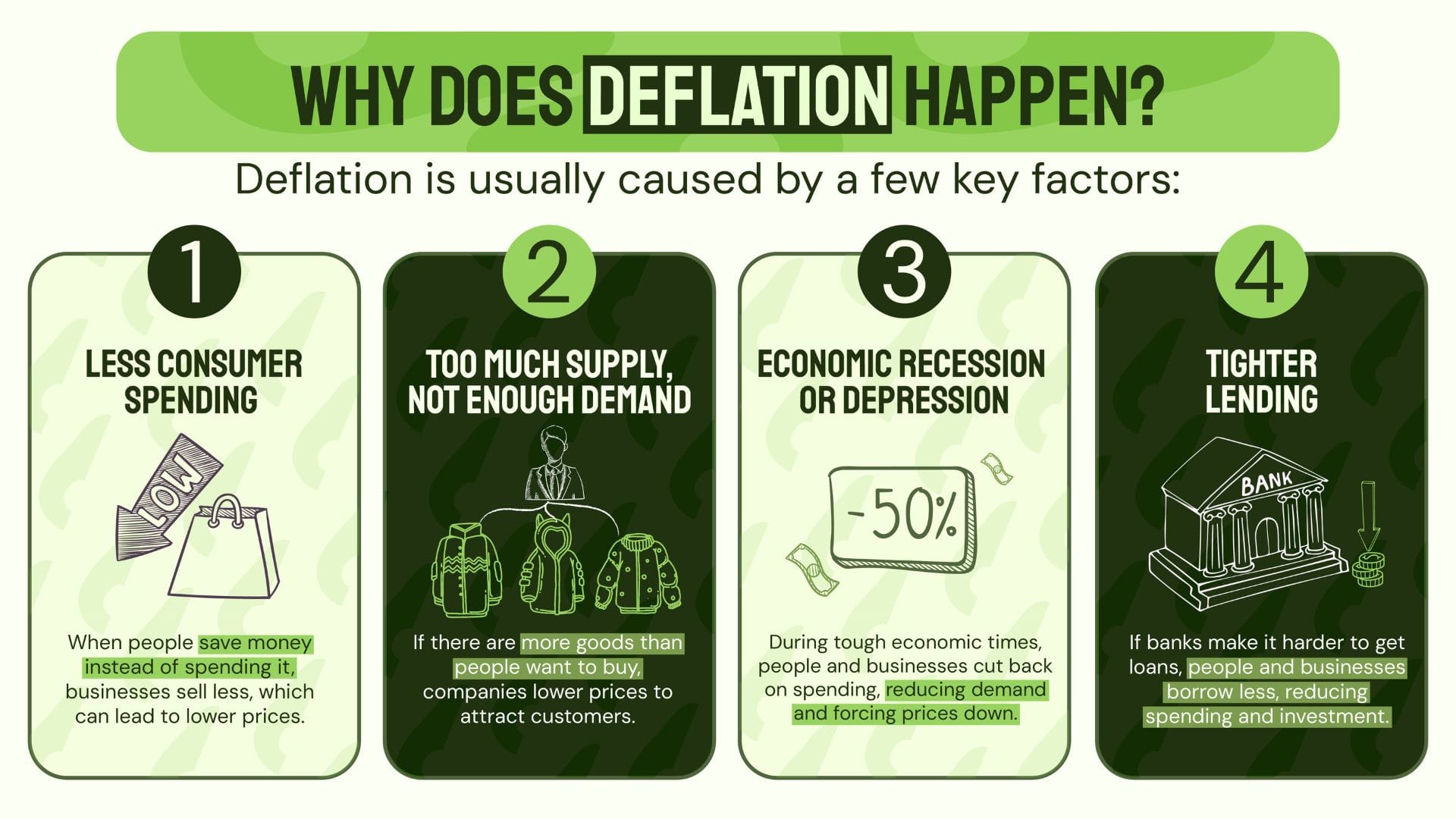

Why does deflation happen?

Unlike inflation, your money is worth more during periods of deflation. To understand why this can be dangerous, imagine you’re planning to buy the latest iPhone. Normally, you'd have to sell off your left kidney to afford it, but the price has dropped due to deflation. You could buy the iPhone now. Or you could wait a few more months for the cost to fall further.

During deflation, most consumers would choose to wait a few months. But if consumers stop spending money, businesses make less profit. To cut costs, these businesses lower their wages and lay off staff. With higher unemployment and lower wages, people have even less money to spend, including you.

That overpriced iPhone might be cheaper, but the price drop won't make a difference if you get laid off or your wages get axed. When consumers make and spend less, it results in an economic contraction, which refers to a period where an economy shrinks or slows.

Governments and central banks fight deflation by encouraging spending and borrowing. They might lower interest rates, print more money, or increase government spending to boost economic activity. These measures aim to make it easier for people and businesses to borrow and spend money, which helps keep the economy stable.

How deflation affects you

If you are a young Canadian, odds are you have some form of debt and it is likely student loan debt. More than half of Canadians with undergraduate degrees have student loan debt and 45% of these loans are held by young people between the ages of 20 and 24. Deflation can make debts more expensive because, even though prices are falling, debts don’t shrink.

To give an example, if you owe $10,000 on a student loan, that amount stays the same even if your paycheck gets smaller. This makes it harder to pay off loans, leading to more debt repayment failures and debt delinquency, which refers to being past due on a payment for a loan or debt, not spray painting the side of banks.

According to a 2024 TransUnion report, consumer debt in Canada hit a historic high of $2.5 trillion in the fourth quarter of 2024. Millennials and Gen Z consumers collectively held $1.1 trillion in debt. Times are tough out there for young people, even if you don't have debt.

Young people are already struggling to find jobs. Being laid off during deflation is like salt in the wound for young people who were lucky enough to get a gig. Unfortunately, youths are twice as likely to be laid off than older employees. To make matter worse, a rising cost of living is making it harder than ever for Canadians to save or invest in safety nets like emergency funds.

Unlike the older generations, which had decades to build up their savings, young Canadians are stuck at the starting line. An H&R Block Canada survey found that almost a third of Canadians feel they don't have enough money leftover from their pay cheque to build their savings. But learning how to protect yourself now will help you do more than just tread water.

How to protect yourself

The best way to protect yourself during periods of deflation is to be proactive, not reactive. Hard times are hard to predict, but why wait for an economic downturn to up your financial game? The best time to improve your money-mindedness, budgeting, savings, and investments, is now.

Paying off your debts should always be at the top of your todo list, regardless of deflation. But paying off debts is easier said than done. The moment you notice prices dropping left and right, prioritize having as little debt as possible before deflation sinks its claws into the economy.

If your budgeting skills could use some work or you're an impulsive spender, this is your sign to learn and improve before you end up with a closet full of knickknacks you'll never use. If that's already you, then now is the time to sell your useless goodies while they still have value because they won't be worth a dime during deflationary periods!

Finally, save as much money as you can and put off unnecessary purchases. Yes, the Samsung fridge you can play Mario Kart on might be cheaper than usual, but your money is better off in an emergency fund or savings account. Don't let deflation take advantage of you and your money!

TL;DR

Cheaper prices might seem like a win, but a long period of deflation is a warning sign of deeper economic problems. A healthy economy needs a balance—prices shouldn’t rise too fast, but they shouldn’t fall too much, either.

Striking a balance in your personal finance is just as important and equally challenging. That why we are here to lend a hand so you can strengthen your finances and weather any storm, be it deflation or inflation.