What is a GIC and is it right for you?

If you are looking for a safe and secure way to grow your money, then a Guaranteed Investment Certificate might be for you!

If you're new to investing and looking for a safe way to grow your money, a Guaranteed Investment Certificate (GIC) might be exactly what you need. This low-risk option is perfect for young professionals who want to save for the short or medium term with the reassurance that their investment is guaranteed.

What is a GIC?

As the name suggests, a Guaranteed Investment Certificate (GIC) is a financial product offered by Canadian banks and trust companies. Essentially, it’s like lending your money to the bank for a set period, and in return, they pay you a fixed interest rate.

Since GICs are insured by the Canadian Deposit Insurance Corporation (CDIC) for up to $100,000, your money remains safe, even if the bank goes under. This makes GICs one of the safest ways to grow your savings without the risks that come with the stock market.

Types of GICs explained

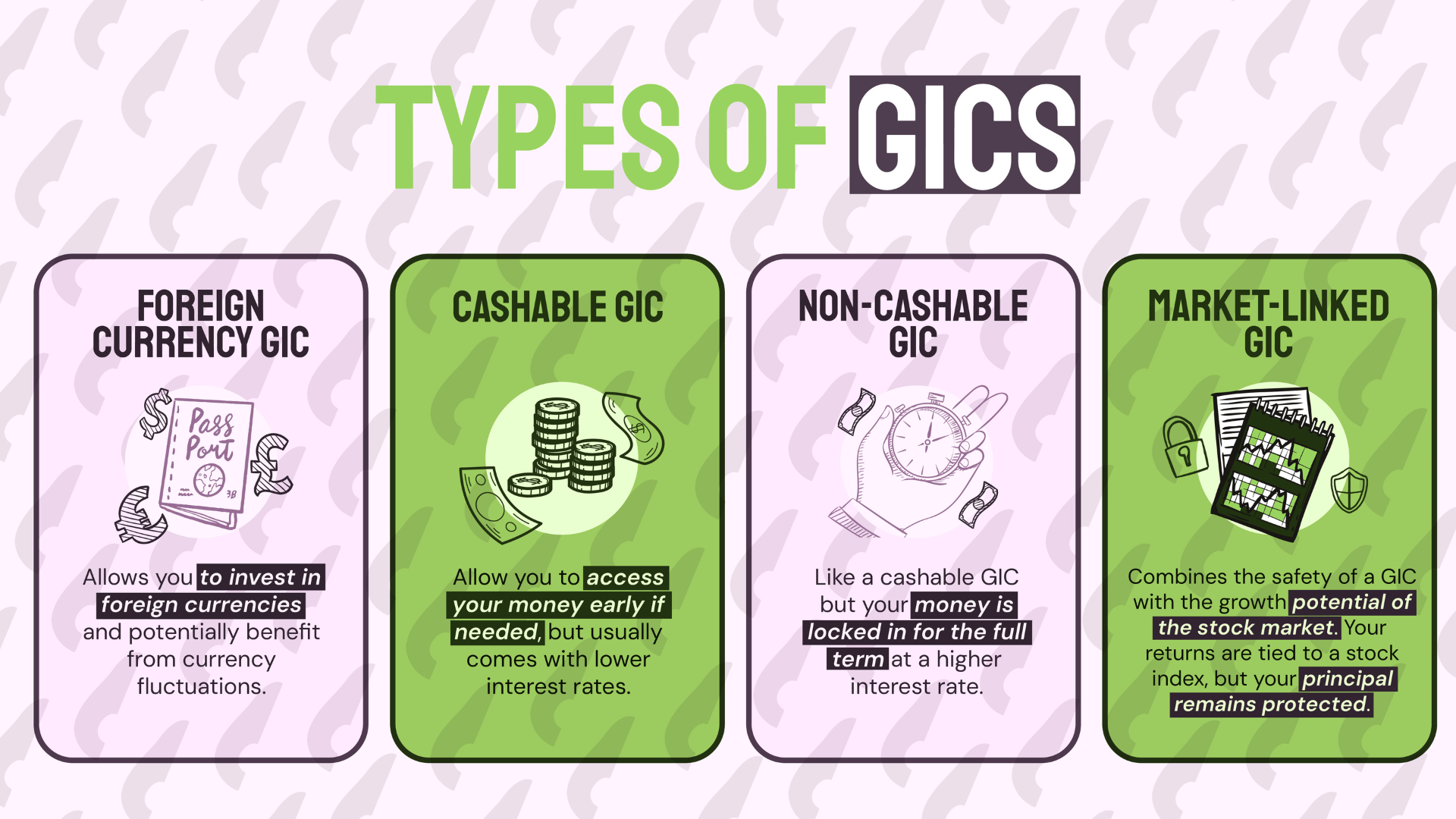

To help you decide if a GIC is right for you, let’s break down the different types and what each one offers:

- Cashable GICs: These provide flexibility, allowing you to access your money early if needed. However, they usually come with lower interest rates.

- Non-cashable GICs: With these, your money is locked in for the full term, but in return, you benefit from higher interest rates.

- Market-linked GICs: These combine the safety of a GIC with the growth potential of the stock market. Your returns are tied to a stock index, but your principal remains protected.

- Foreign currency GICs: These allow you to invest in foreign currencies like U.S. dollars or euros, offering a way to diversify your portfolio and potentially benefit from currency fluctuations.

Pros and cons of GICs

Here are some key benefits and drawbacks of investing in GICs:

Pros:

- Guaranteed returns: GICs guarantee a fixed return, unlike riskier investments like stocks.

- No fees: You don’t have to worry about management fees or trading commissions, so your investment grows uninterrupted.

- Simple and safe: GICs are easy to understand—deposit your money, wait for it to mature, and collect your interest. Plus, your principal is guaranteed by the CDIC.

Cons:

- Low returns: GICs generally offer lower returns compared to other options like stocks or mutual funds.

- Limited liquidity: With non-cashable GICs, your money is locked in until the end of the term, which may limit your access to cash in case of an emergency.

- May not beat inflation: While GICs have a guaranteed return, their interest rates may not keep up with inflation, which could erode the value of your savings and purchasing power over time. If you would like to learn more about purchasing power, check out this blog post!

- Taxable interest: If held in a non-registered account, the interest earned on GICs is fully taxable at your marginal tax rate.

When to Invest in a GIC

One important factor when investing in GICs is the interest rate. GICs offer fixed rates, which can vary depending on the term length and type of GIC.

It is commonly understood that locking in a GIC now could yield better returns compared to more liquid options like savings accounts, but that’s not always the case.

In 2024, the Bank of Canada has been continually reducing interest rates, which has impacted long-term GIC returns. For example, in September 2024, the interest rates for 1-year GICs are mostly above 3% and cannot compete with the returns from some HISAs that are above 5%.

Pro tip: If you have a large amount of money, think about using a GIC laddering strategy. This can help you get the most from your investment and make the best use of available GIC options.

Something to consider: GIC is a smart choice if you have a specific financial goal, like saving for a down payment on a house, building an emergency fund, or preparing for a big life event. The guaranteed return gives you peace of mind, letting you focus on your goals without stressing about market ups and downs.

Comparing GICs to other investments

Understanding how GICs compare to other investment options is crucial for making informed decisions:

- GICs vs. stocks: Stocks can offer high returns but come with greater risk. GICs, by contrast, provide steady, guaranteed growth with less risk.

- GICs vs. mutual funds: Mutual funds let you invest in a diversified portfolio, offering higher returns but also market risk. GICs guarantee returns but lack the growth potential of mutual funds.

- GICs vs. bonds: Both bonds and GICs are low-risk, but bond prices fluctuate based on market conditions. GICs offer fixed returns without market volatility.

- GICs vs. high-interest savings accounts (HISAs): GICs typically offer higher interest rates than HISAs, but you must lock in your money for a set term.

HISAs, on the other hand, provide immediate access to your funds. Many HISAs often offer enticing promotional rates, which may decrease after the end of the promotional period.

It is best to compare the annual percentage yield (APY), which shows how much interest you will earn over a year when considering whether to choose GICs or HISAs.

Tax considerations for GICs

If you hold GICs in registered accounts like a Tax-Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP), the returns are either tax-free or tax-deferred. This allows your investment to grow without immediate tax implications. However, GICs held in non-registered accounts are subject to taxation. The interest earned is considered taxable income.

TL;DR

GICs are an easy, safe, and guaranteed way to grow your money, making them a great choice for beginners or anyone looking for a low-risk option and not in urgent need to use the money.

While they may not earn as much as stocks or mutual funds, they are perfect for short- to medium-term goals like saving for a down payment, building an emergency fund, or getting ready for important life events.