Understanding the Consumer Price Index

Knowing what the Consumer Price Index is will go a long way toward helping you save money even during times of high inflation! Here's what you need to know to stay one step ahead.

Everyone always asks what inflation is but hardly anyone asks how inflation is...calculated. While it might feel like it sometimes, Inflation isn't a number governments' pull out of a raffle.

A lot of work goes into determining inflation, but what if we told you that you could calculate inflation yourself, no mathematics degree required! Before you can prove your genius at the next family dinner, we need to understand how the Government of Canada calculates inflation.

By the end of this blog, you will be equipped with the economic know-how to stay one step ahead of inflation and make the most of your hard earned money using the Consumer Price Index (CPI).

How inflation is calculated using the CPI

Every month, Statistics Canada fills a virtual basket with about 700 goods and services Canadians commonly buy.

These items are given a weight that depends on how much a typical household spends on each item. For example, Canadians usually spend more on groceries than coffee, or at least we hope so.

As a result, necessities like groceries are weighted more heavily than a commodity like a Pumpkin Spice Latte from Starbucks. That being said, one person’s definition of a necessity or commodity can be very different from someone else's.

If you have a caffeine addiction, you could very well consider coffee a necessity. That’s exactly why Statistics Canada prioritizes determining what items Canadians buy most frequently instead of basing its basket on necessity versus commodity.

A price increase for “heavier” items has a greater effect on a household’s average cost of living. For instance, a 20% increase in rental rates is going to have a much greater impact on a household’s budget than a 20% increase in avocados (it might be close in this economy).

The agency then adds up the total to create an average, known as the Consumer Price Index (CPI).

To summarize, the CPI represents the average price of a basket of consumer goods and services. This average is used to measure changes in the prices paid by consumers over time.

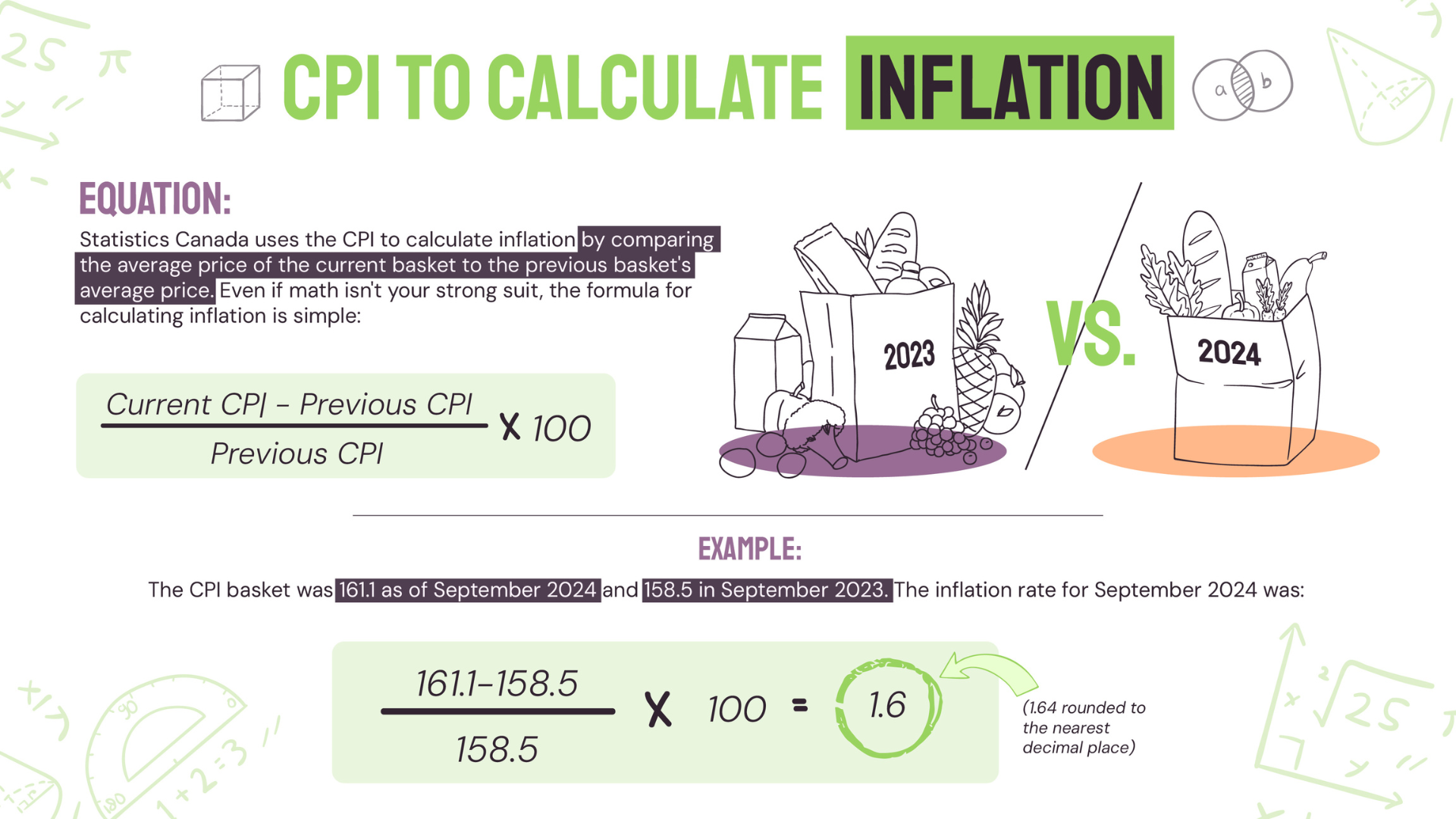

Statistics Canada uses the CPI to calculate inflation by comparing the average price of the current basket to the previous basket’s average price.

To put this formula into practice, the CPI basket was 161.1 as of September 2024. The CPI basket was 158.5 at the same time the year prior. Using the formula above: 161.1-158.5/158.5 x 100 equals 1.64. The inflation rate is rounded to one decimal place, bringing out value to 1.6.

Congratulations! You now have the inflation rate for September 2024! In addition to inflation, the CPI can also be used to track deflation. Using the example above, if the CPI were to instead decrease between 2023 and 2024, it would be a warning sign of deflation.

Let's say the CPI for September 2024 was 156.5, compared to 158.5 in 2023. Using the same formula, our new inflation rate would be -1.7, indicating that prices are falling and deflation is taking root.

Knowing how to calculate the inflation rate is a cool party trick (depending on who you ask). But understanding why the inflation rate changes is even cooler.

Why does the inflation rate change?

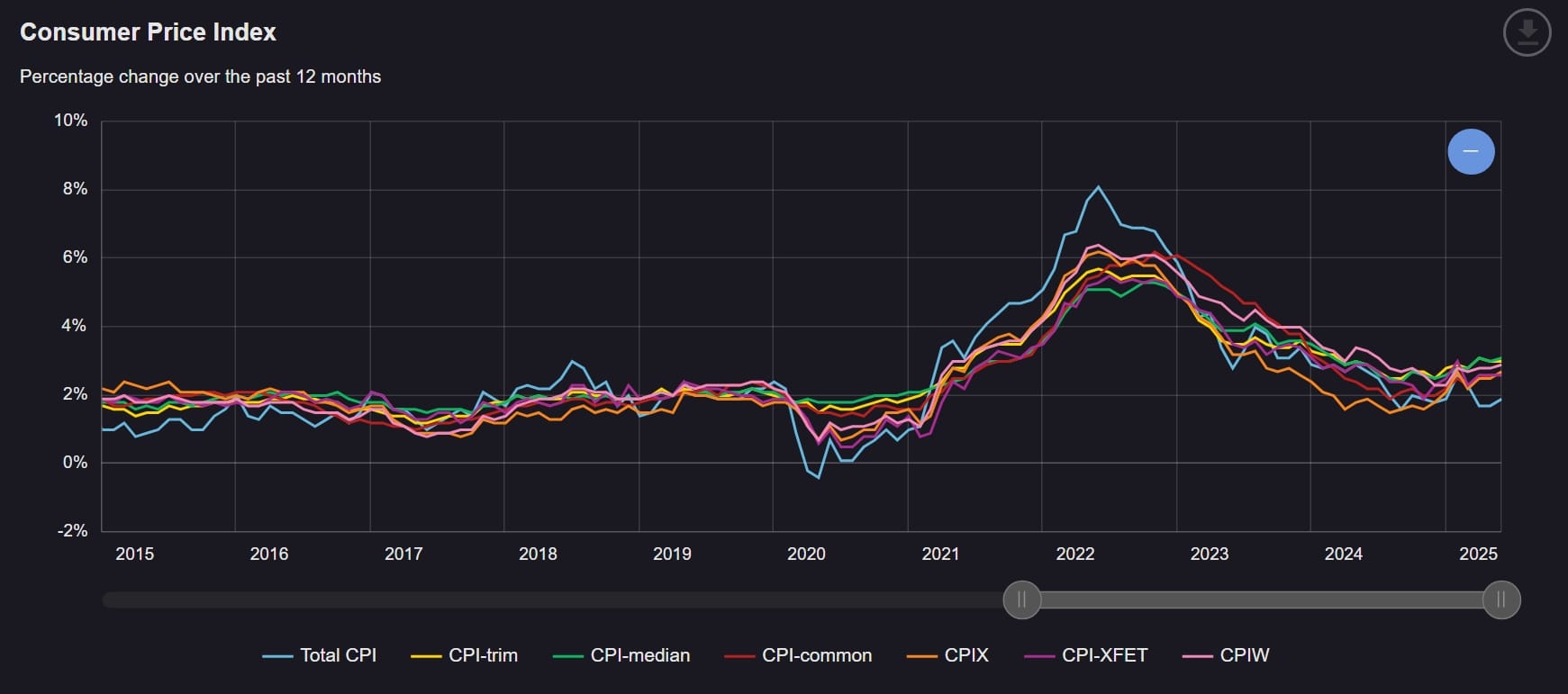

The best way to stay up to date about the inflation rate is to keep Statistics Canada's Consumer Price Index Portal in your pocket. Here, you will find all sorts of information, including a breakdown of what is causing the inflation rate to change.

For example, the inflation rate decreased to 1.8% in December 2024, down from a 1.9% increase in November. The agency cites a temporary GST/HST break on certain goods introduced on December 14 for this change.

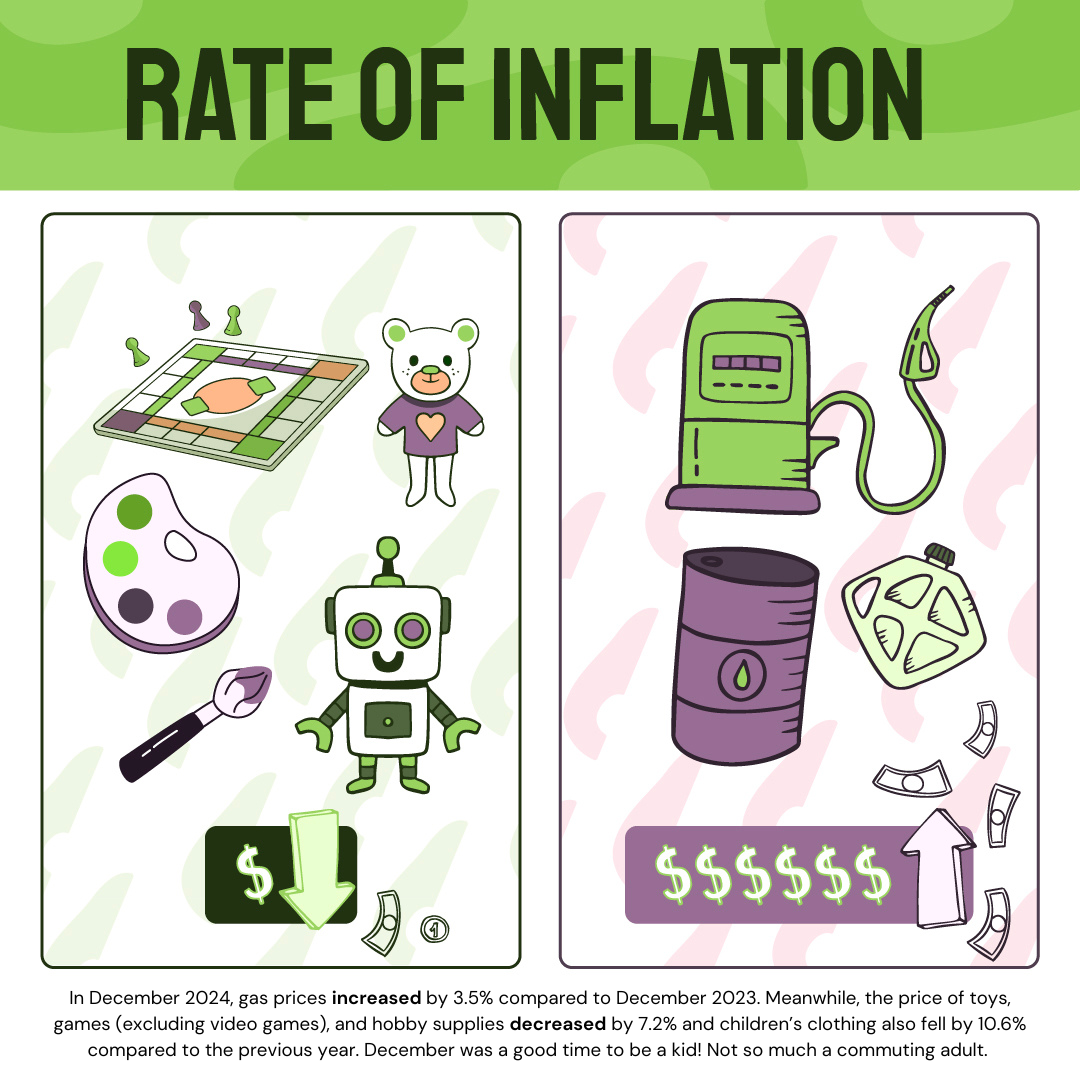

Statistics Canada's portal also provides a summary of what goods and services have increased or decreased. In December 2024, the price of gas increased while the price of toys, games, and hobby supplies fell by over 7%.

While the CPI portal can't tell you what goods or services will be cheaper in the future, it provides useful insights that can help you make educated predictions.

For example, clothing and footwear prices rose 2% in June. The CPI portal explains that prices increased due to uncertainty surrounding international trade. Knowing this information and the fact that the trade war isn't going anywhere soon, you can safely assume that prices for these goods will not decrease soon. So, it might be worth putting off updating your wardrobe!

On the other hand, if the CPI portal points out that grocery prices have dipped but are expected to increase, stocking up or buying groceries in bulk could help save you money in the long run.

Using the inflation rate to protect and maximize your finances

The CPI can be used to calculate and gauge inflation/deflation. This information can be used to help you protect and maximize your finances. How? We're glad you asked!

When inflation increases, the purchasing power of your money decreases. In other words, your money can buy less. This applies to more than just the cash in your wallet! Inflation also affects financial tools that are prone to inflation, such as GICs, bonds, and certain savings accounts and investments.

If the inflation rate outpaces the interest rates of your savings account(s) or your return on investment (ROI) in the stock market, your money is losing value because it is growing slower than the price increases caused by inflation. Let's use a low interest savings account as an example.

If you put $500 in a savings account that offers annual interest of 2%, you would have $510 in a year. If the inflation rate is 6%, your savings are growing 4% slower than the price of goods and services. The $510 you saved over the course of a year can now buy less than $500 could a year ago.

Your bank account won't show you that your purchasing power is decreasing, which is why it is so important to keep yourself updated on inflation rates!

How to protect and maximize your finances during inflation

- Move your money: if you have money is a savings account offering an interest rate below inflation, consider investing it in assets that are resistant to inflation like real estate and gold

- Stay on top of your budget: budgeting will help you spend within your means and ensure you aren't spending unnecessarily (if you haven't started budgeting, we won't tell anyone BUT this is your sign to start!)

- Know your worth: wage increases should keep up with inflation, but this isn't always the case. Similar to money in a low interest savings account, your wages also loses value if earnings are outpaced by inflation. If you get a 2% raise but the inflation rate is 4%, your paychecks might grow, but not enough to match the increased price of goods and services

TL;DR

Understanding the CPI and how inflation is determined might looks scary, but its a lot easier than corporations, mainstream media, or your shady boss would have you believe! Staying up to date about the inflation rate will help you stay ahead of inflation so you can maximize the worth of your money, which can be put toward securing your financial future through investments and savings!