Should you open a High Interest Savings Account?

A HISA can be an invaluable tool in your savings arsenal, but its usefulness depends on your financial plans.

TL;DR

- HISAs are here for a good time, not a long time so they excel at short-term savings (emergency funds, vacations funds, date night funds, etc.)

- HISAs offer high interest rates so you can save more, faster. Too good to be true? Keep reading to find out!

- You can access funds in a HISA without penalty in most cases, but beware! Some HISAs might have transaction limits

- HISAs offer high interest rates, but rates could change at any time, kind of like the weather

- Any interest you earn through a HISA is taxable. Boo!

Whether you're saving for retirement, a new car, or just building that emergency fund, where you keep your money matters. Here’s what you should know about High Interest Savings Accounts (HISAs) so you can decide if this savings account is a tool worth adding to your financial toolbox.

What is a HISA?

A HISA is exactly what it sounds like. A savings account that offers you higher interest rates than traditional savings accounts, meaning you can grow your money faster.

HISAs really shine when it comes to hands off, short-term savings. You put money in it, watch it grow, and pull it out when you’ve reached your savings goals or need to repair the plumbing that your landlord refuses to replace.

So, what’s the catch? Don’t worry, you don’t have to sell your soul or give up avocado toast to reap the benefits of HISAs. But like any savings account, HISAs come with their own perks and limitations. Let’s talk about them.

HISA Perks:

Higher interest rates

HISAs offer higher interest rates compared to traditional savings accounts. At the time of publishing this blog, the average HISA interest rate in 2025 is between 1% and 2.5%, but some banks might offer promotional rates of 4% or more for a limited time.

If you put $15,000 into a HISA with a 4% interest rate, your savings would grow by $600 by the end of the year ((15,000*0.04)*1 = 600). If you put the same amount into a traditional savings account with an interest rate of 0.850%, you would only earn a little over $127.

That’s not quite enough to buy that all-inclusive trip to Mexico that you’ve been eyeing for next year.

Accessibility

Unlike Guaranteed Investment Certificates (GICs), you can usually access the money you put into HISAs without incurring a penalty. This accessibility ensures that your money is always available when you need it, making HISAs a great contender for emergency funds or short-term savings (generally six months to a year).

HISA Limitations:

Variable interest rates

Like most savings accounts, the interest rate for HISAs can change at any time. Banks might offer a shiny promotional interest rate that hooks you, but that rate is not guaranteed like it would be with a GIC, and could increase or decrease. Keep this in mind when shopping for the best HISA rate!

Transaction limits

While HISAs don’t typically charge withdrawal fees, some institutions might have withdrawal limits that restrict how many withdrawals/transfers you can make in a billing cycle before you get charged. Remember! HISAs should be mostly hands off, so this shouldn’t be a problem!

Don’t forget about taxes

Unlike with TFSAs, the interest earned on HISAs is considered taxable. For example, if you earn $2,000 in interest through a HISA, that amount will be added to your taxable income for that year. However, TFSAs are neat because they can store a number of assets that would normally be taxable, like HISAs.

By storing a HISA in a TFSA, you can benefit from higher interest rates without getting taxed. Remember! Anything you add to your TFSA takes up contribution room, including HISAs!

Limited growth potential

HISAs are really good at doing one thing, and that’s growing your savings fast. But in the long term (generally five or more years), HISAs are often beaten out by financial tools with more growth potential like stocks that offer returns in the form of dividends and capital gains.

The average return from the stock market is about 10% per year, but that rate is reduced by inflation. A more realistic expectation is a return of 6% per year. If you put $15,000 into a HISA with a 2.5% interest rate, you would earn $3,750 after 10 years (based on a hypothetical scenario where the interest rate does not fluctuate like it normally would).

If you invested that same amount in the stock market with an expected return on investment of 6%, you would earn $9,000. However, investing in stocks carries a lot more risk than parking your cash in a HISA and calling it a day. A bad investment could lose you money; you can’t lose money in a savings account (but you could technically lose purchasing power if inflation outpaces your interest rate)

Is a HISA right for you?

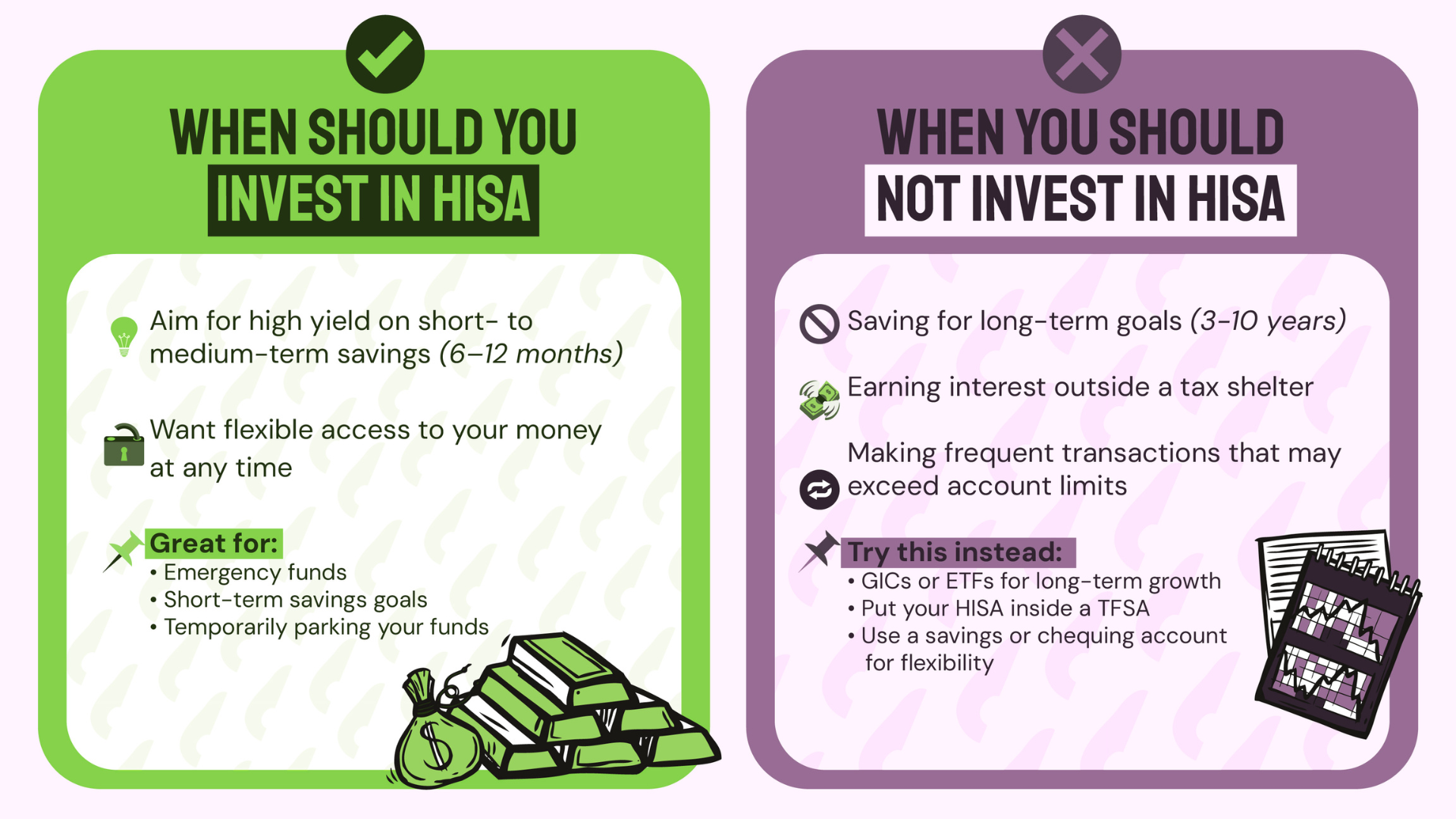

When it might be…

High interest rates make HISAs great for quickly growing short-term savings that can be accessed whenever you need the money, like for buying a car next year or setting up an emergency fund.

When it might not be…

If you are saving for retirement or plan on saving money over the course of several years, HISAs are often outperformed by investment options with higher long-term growth potential.

Tending the garden

Are you looking to grow your savings tax-free long term while also having the flexibility to store your assets and make investments? Then a TFSA is your best bet. Are you looking to get a head start on saving for retirement? Time to open an RRSP. Did you get $300 for your birthday that you don’t know what to do with? Plop it in a GIC.

Growing your savings is like growing a garden. It’s all about using the right tools for the job. You wouldn’t use a pruner to water your plants. In the same way, you wouldn’t use a HISA as a retirement fund.

A HISA is one of many financial tools at your disposal that you should use to maximize your savings and make the most of your hard-earned money! The difference between a financial gardening pro and a novice is knowing the best tool to use for every job!