How to avoid being sucked in by the sunk cost fallacy

If you have a hard time letting go of bad investments, odds are you are trapped by sunk cost fallacy! Here's what you can do to avoid it.

TL;DR

- The sunk cost fallacy is a cognitive bias that happens when we keep putting time, money, or effort into something just because we’ve already invested in it.

- People with sunk costs often expect a higher chance of success because our brains hate losing more than they like winning.

- Brands use tactics to trick us into thinking we’re winning a good deal, but this often leads to us spending more on things we don’t need.

- Conducting a regular life audit can be a great step to review sunk costs. Being intentional by setting clear expectations, knowing when to decide, and seeking external advice constantly can help us make better decisions. (Another reason why you should follow Avotoast.ca!)

Have you ever stayed in a toxic relationship just because you didn’t want to throw away the time, effort, and all the good memories you once had in it?

Not wanting our investments to go to waste is part of human psychology and nothing to be ashamed of. If you can work things out with your partner, that’s awesome! But if you decide to stay in that relationship and get no satisfaction out of it, you might be experiencing the sunk cost fallacy.

What is the sunk cost fallacy?

The sunk cost fallacy is when we feel compelled to keep putting time, money, or effort into something because we’ve already invested in it, even though we can’t get those past costs back. We do it to avoid feeling wasteful or guilty, but it is not always the smartest choice. Letting old investments control future decisions can end up hurting us instead of helping.

The sunk cost fallacy comes in different forms

The sunk cost fallacy can show up in ways we don’t always notice. This cognitive bias makes us vulnerable as our brains naturally resist the feeling of failure and chase small rewards. Brands know this and often use it to their advantage by designing offers and campaigns that make us spend more, even on things we didn’t plan to buy.

Here are a few of the most common tactics that keep us stuck in the sunk cost trap.

Initial investment reminder

Ever ordered Uber Eats and seen a pop-up at checkout that says, “Spend $30 and get 50% off on vegetable spring rolls”?

Many apps use this tactic, encouraging you to max out your lunch order to reach $30 so you can get that spring roll discount. By reminding you of your initial investment, marketers try to trick you into thinking that if you’re already spending money, why not spend a little more?

The result is you end up spending more on food you didn’t really want. Here’s the thing: just because you’ve made an initial investment doesn’t mean you have to stick with your decision or invest more. Focus on what you need, not what others want you to think you need.

Emotional manipulation

We've heard it many times: "exclusive deal only for our valuable customers" or "special deal for someone like you". By using keywords, phrases, and programs that remind customers of their long-term investment in a brand, companies foster a sense of loyalty (and royalty). This often makes customers feel obliged to keep supporting the brand.

For example, airlines often use loyalty programs to express gratitude for continued support, offering perks like a "free" spa day if a certain membership tier is reached. But if you think about it, is a spa day really worth spending an extra $10,000 on flights to nowhere? If you wanted a spa day, you could book an appointment for much less, right?

Remember, your time, money, emotions, or whatever else, are yours to control. You don’t owe companies or anyone anything, especially if they no longer benefit you.

Minimum effort for better deals

Remember that time you tried to cancel Netflix and suddenly get offered a 50% off the next month? Or maybe you’ve unsubscribed, only to get an email a few months later saying “It’s been a while. Come back and your first month is on us”?

You might feel like you’re the cleverest person in the world for being able to outsmart such a big corporation. But in reality, they’re counting on you taking the minimum effort to crawl back to them. The next thing you know, you could end up paying for a 6 month subscription without having watched any shows. In fact, this research has found that those who had a sunk cost tended to believe that the decision was more likely to succeed than people who had not invested anything.

Saving 50% on a subscription you don’t need is still money wasted. And if you’re too busy to cancel again, that “cheap” first month can turn into months of charges you never planned for.

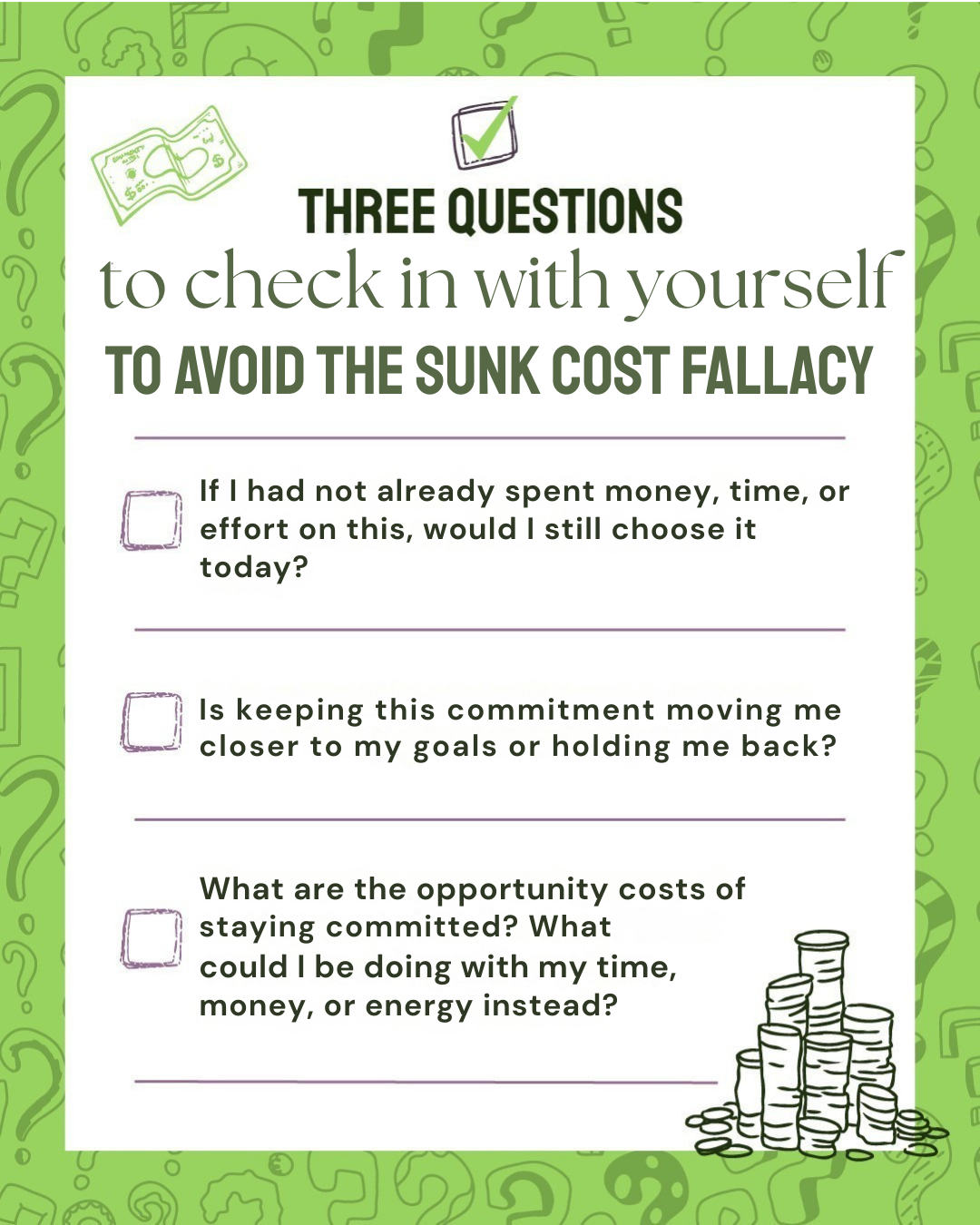

How to avoid falling for the sunk cost fallacy

Knowing how to recognize sunk cost fallacy in your own life, whether it's a failing relationship or five extra pizzas when you only wanted one, will help you make decisions that prioritize future benefits over past investments.

Here are a few ways you can avoid falling for the sunk cost fallacy in your own life.

Conduct life audit

An out of sight, out of mind approach to investments can be very dangerous. If you invested $5,000 into Apple, you wouldn’t call it a day and let Jesus take the wheel, right? You would stay up to date on the company’s financial reports and check in on your investment regularly.

Checking on your investments regularly allows you to recognize losses sooner rather than later, preventing you from losing even more. Although the interval for check-ins depends on the investment, it is nice to conduct a life audit at least once a quarter or once a month. This allows you to correct errors in time to minimize losses or maximize returns if their investments are doing well.

Seek external advice

Just like you'd ask a friend for relationship advice, it's smart to get a third-party perspective when you're unsure if you're making a logical decision.

As mentioned earlier, the sunk cost fallacy often clouds our judgement because we hate the idea of losing more than we love the idea of gaining. The problem is, this bias is hard to see in ourselves, but outsiders can often spot it right away.

Take this example: you find a cheap apartment close to work and move in, even though the vibe feels off. Over time, you start feeling unwell, and a doctor tells you the poor air quality in the house is the cause. You hesitate to move because the rent is so low and you have already moved all your stuff in. Then your parents visit and ask, “Why would you trade your health for cheap rent?” That outside perspective makes the decision suddenly clear.

An outside perspective can be the wake-up call we need to cut our losses or the reassurance to stay the course.

Set clear expectations and know when to quit

It might sound cliche but having a goal in mind and defining what success looks like will help you stay on track. For example, saying you want to see a return of investment from your crypto by 25% in 2 years is a lot easier to track than saying you want to increase ROI by “a lot.”

Because you have a clear goal and have defined what success looks like (a 25% ROI), you can more easily gauge whether or not you will hit your goal. If you’re on track, keep going! If not, it’s often smarter to cut your losses, reflect on what went wrong, and use those insights to create a stronger plan for the future.