How do taxes work?

Tax season is here, but have you ever stopped to ask yourself why you are being taxed in the first place? We are here to answer that question!

In the wise words of Benjamin Franklin, "In this world, nothing can be said to be certain, except death and taxes." Many of us probably grew up with our parents mumbling some iteration of this saying under their breath (just with more expletives) whenever tax season rolled around. Back then, we didn't have the slightest clue about taxes or how they affected us, and we didn't have to worry about the Canada Revenue Agency (CRA) taxing our $20 allowance.

FUN FACT: Cash gifts from friends or family like allowances, are not taxable, meaning you don't need to report them to the CRA.

The only thing "taxing" about being a kid was having to do chores or go to school. Being an adult is way harder. However, our understanding of taxes hasn't changed much in adulthood. Many people still pay taxes without really knowing what taxes are or how they work. Greedy corporations and corrupt governments that misuse tax money give taxes a bad reputation, but there are actually many benefits to paying taxes. Taxes aren’t the (real) villain, and here’s why.

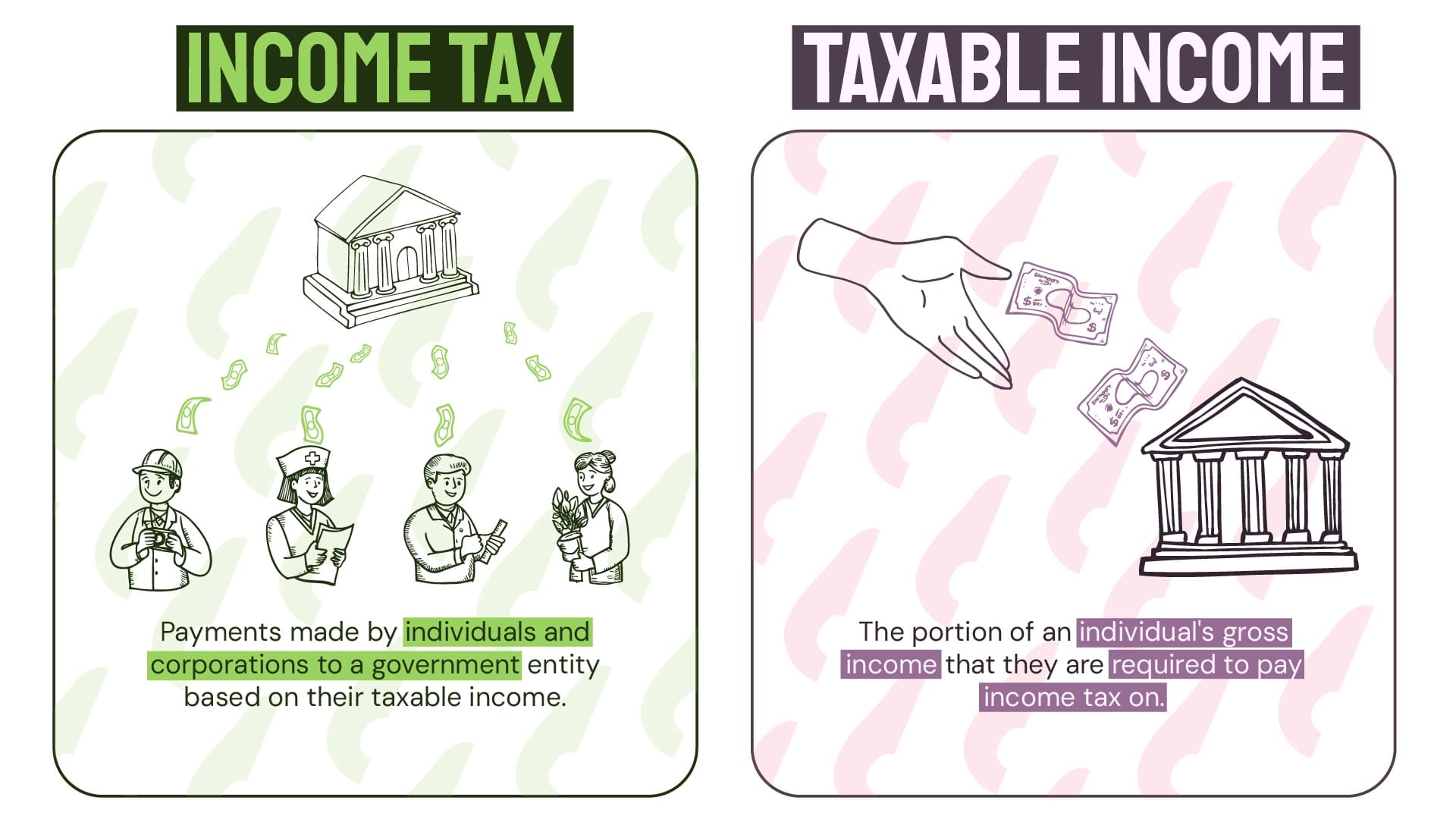

The importance of income tax

There are about as many kinds of taxes as stars in the night sky. Okay, maybe not that many. Thankfully, most Canadians only have to worry about income tax. Canadian residents are required to report their income on their tax return to the CRA and pay taxes if they make an income at or below the basic personal amount (BPA).

BPAs are the amount of income that you can earn before you are required to pay taxes. The BPA for 2025 is $16,129, meaning if you make less than this amount, you are not required to pay taxes on your income. Hooray!

Income tax is a portion of your annual income that is paid to the Canadian government. You work hard for your money, but the money you give to the CRA isn't for nothing. That money goes toward keeping Canada's wheels spinning.

Contrary to popular belief, the CRA isn’t the tax boogeyman. Instead, think of the CRA as the tooth fairy, but for adults. Instead of leaving teeth under your pillow, you leave your tax return. In return, you gain access to a number of services and programs that would otherwise be unavailable if you didn’t file your tax return, which includes info about your income, expenses, and the amount of taxes you are required to pay.

Don't miss out on free money!

Even if you don’t have an income or make less than the BPA, you are still eligible to receive certain tax credits and benefits by filing your taxes. For example, you need to file a tax return to receive the Canada child benefit (CCB), a tax-free monthly payment to eligible families to help with the cost of raising children.

The CCB is one of many programs offered by the Canadian government to people who submit their tax returns. Another benefit to filing your taxes is the ability to claim certain deductions, credits, and expenses like moving expenses and interest payments on student loans, to name just a couple. Not filing your taxes means missing out on these potential benefits. See? Taxes aren’t so bad!

Paying taxes does more than fix potholes

There are many more benefits to filing and paying taxes than just claims. On a large scale, the taxes you pay go toward supporting federal, provincial, and municipal levels of government. Our country's publicly-funded universal health care system is the perfect example. The taxes you pay go toward supporting this system and the people who rely on it. Yes, that includes you when you broke your arm falling out of a tree.

Closer to home, taxes help pay for programs and services like libraries, police services, transit, road services, social development, and much more. When your city's roads are about as flat as the Rockies, your taxes go toward repairs and improvements, or at least they should. Unfortunately, the people who are expected to use the taxpayers’ money responsibly aren’t always trustworthy.

Taxes aren't the villain

What people consider to be a waste of tax money is subjective, but most people can agree that Premier Danielle Smith's plan to use taxpayers' dollars to help greedy oil and gas companies clean up their own mess is nonsense.

At the very least, the Premier’s plan proves that the people of Alberta rank very low on her list of priorities. Their money, on the other hand, is very important. Some people are quick to criticize others who rely on social assistance programs or restaurants that make use of tax incentives.

Holding the real villains accountable

But what about mega-corporations like Apple that are known for dodging billions in tax revenue? If taxes are so great, why do these companies try to dodge taxes at every opportunity? Because they only care about lining their own pockets, not supporting a future where everyone can thrive. They don’t care about helping you raise a family or get through university.

These companies need to be held accountable, both by the government and by us. If we are expected to pay taxes, so should billionaires like Tim Cook. Want to join us in calling them out? Head to our socials to see how.

Yes, paying taxes suck but they are not the villain they are made out to be. It is the misuse of tax money and the greedy corporations that avoid paying taxes that leave a bad taste in the mouths of taxpayers.

TL;DR

Knowing what taxes are and how they work is the first step toward understanding why they are important. At the end of the day, taxes keep the wheels spinning for services like healthcare, road management, and public programs, but it’s often their misuse—not the taxes themselves—that frustrates people.